| < | Wavepacket Blog only displaying 'economics' posts |

> |

| << Newer entries << | |

| 2008 | |

| October | |

| Sat Oct 4 22:13:42 2008 Is Capitalism Dead? |

|

| Sat Oct 4 21:32:25 2008 Congress says Yes |

|

| September | |

| Mon Sep 29 21:17:40 2008 Just say No |

|

| >> Older entries >> | |

| >> links >> | |

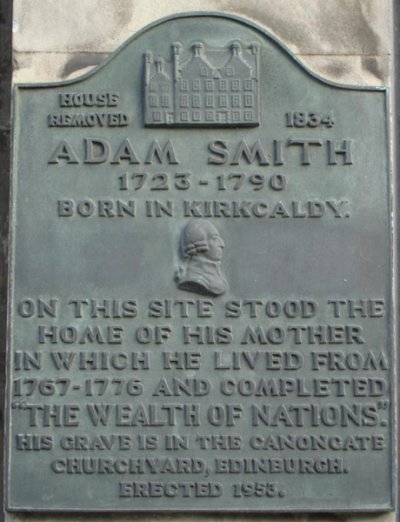

| Sat Oct 4 22:13:42 2008 Is Capitalism Dead? Apparently some people think so... |

|

| In

Congress says Yes, I noted that the Emergency Economic Stabilization Act of 2008 has been

passed into law.

Not surprisingly, other people have noted that too. This week's copy of The Week led with an article titled "Is Capitalism Dead?", featuring a caricature of Adam Smith's tombstone with the dates 1776-2008. The byline was "A bitter farewell to the free market." Inside, the magazine gave different viewpoints on the impact of the passage of the Act. On the right, people claimed "Capitalism is Dead." On the left, people claimed "Capitalism has Evolved." I was surprised that so many people got it dead wrong! Was Capitalism killed by the Great Depression? The nationalization of industries, and founding of the welfare state, didn't seem to have killed of Capitalism at all! The article did mention the Great Depression tangentially, but none of the impact was mentioned. Likewise, think of World War II. Most of the economy was controlled. Prices were fixed for many commodities and foodstuffs. The government had people buy war bonds to keep inflation down. This was massive government intervention into the economy, nothing like a free market at all! Not surprisingly, that didn't come up in the article. I think the truth is more nuanced. The free market is an economic game played with certain rules. Within the boundaries of the rules, it is a free market in that players (consumers, business, employers, employees, etc.) are free agents empowered to make their own choices--and in particular, to invest their time and money in whatever ways they think will maximize their return. This is as true for individuals and employees just as much as it is for the corporations that employ and sell to them. However, the rules themselves are set by those empowered to control the markets. The Federal Government has always changed the rules when necessary (Great Depression, World War II). This is just another case. Don't get me wrong, I do not like the Emergency Economic Stabilization Act. But don't confuse that Act with the end of Capitalism! This is just another (possibly successful!) attempt to change how the markets operate to make the country better off. Even Adam Smith was aware that markets play by the rules set by the governments that can control them. In his time, the dominant economic principal was Mercantilism, which had a huge impact on the "free market" and how the United Kingdom dealt with her colonies and other nations. I think the claim that the EESA kills capitalism rests more on ignorance of how governments and capitalism interact than reality. I suspect that in 5-10 years we will be in another boom cycle and people will again be saying it proves how Capitalism is the best system in the world. Of course, we'll still be paying for EESA. Comments |

Related: > economics < Unrelated: books energy environment geopolitics lists mathematics predictions science |

| Sat Oct 4 21:32:25 2008 Congress says Yes The $700B bailout is now law. |

|

| In

Just say No, I celebrated that Congress had not passed the

Emergency Economic Stabilization Act. In my view, that would be money spent on Wall Street financiers without

clear benefit for US taxpayers.

However, the House and Senate have now approved an amended version of the Act, and Bush signed it into law on Friday. So now $700B of our money will be given to Wall Street. I am disappointed! I do feel that this will save mostly the wealthy investment banks, based on a sense of panic. I know credit markets tightened, but was this the only way to loosen them? Well, it is sad, but at this point it is now up to the Treasury and the Federal Reserve to implement the plan wisely. [As an aside: I did receive a nice form letter from Senator Murray as a response to my open letter. And I'm not being facetious--I'm sure it was actually a lot of work to properly respond to everyone that contacted her, even with a form letter.] With luck, the people holding the purse strings will be able to keep the money from flowing into doomed investment instruments. We will know in a few years! Comments |

Related: > economics < Unrelated: books energy environment geopolitics lists mathematics predictions science |

| Mon Sep 29 21:17:40 2008 Just say No Congress shuts down the bailout. |

|

| Well, Congress

said no today. I'd like to think it was my aggressive blogging that helped stop the

bill's passage.

On the one hand, I think we can breathe a sigh of relief. This was a bill desperately wanted by financial institutions so they could cap their losses and dodge responsibility for their poor risk management. I still believe that the clamor of Wall Street was ringing more in the ears of Bernanke and Paulson than Main Street. This means that, if needed, that $700B can be used to help stave off a recession in other, more practical ways. On the other hand, now what? The markets didn't like the news, of course. The Dow Jones Industrial Index dropped 777 points, which, as every reporter noted, was "the largest single-day point loss in history." Interestingly, that means it wasn't the largest percentage drop. The 777 drop was 6.8%, which wasn't really close to the Black Monday (1987) drop of over 22%. Weird that they didn't mention that today's drop was less than a third as bad as Black Monday! But of course that doesn't sell newspapers. And the economic news wasn't all bad. Oil posted a large price drop, now down to a price of around $95 per barrel. Commodities holders are worried that lower demand will keep prices down. Of course, consumers of commodities are in better shape! Not that I'm getting cocky. The economy is still in for a rough ride, and there could be further negative impacts ahead. Well, what will happen now? I'm guessing that not much will happen legislatively until after Election Day. Members of Congress will be far too worried about their jobs to take a chance on a very expensive bill. The political maneuvering was excellent. President Bush proposed it, argued for it, and lost. So now he can claim a recession isn't his fault. Senators McCain and Obama did the same thing. However, we are still left holding the bag, and the government will have to step in to help keep things from collapsing. Here are my predictions:

A 6 month recession isn't bad! I am gambling that the subprime mortgage crisis has not infected the majority of commercial banks, so the banking system as a whole will keep going. And I'm guessing that the consumer slowdown, which has already started, will continue for just a bit more. But the bottom will be reached as those firms who still have assets are able to capitalize on the situation, and risk-takers will take advantage of cheaper credit and lower prices. Comments |

Related: > economics < predictions Unrelated: books energy environment geopolitics lists mathematics science |

| Links: |  |

Blog Directory | Blog Blog | Technorati Profile | Strange Attractor |