Wavepacket Blog only displaying 'geopolitics' posts |

> |

| 2012 | |

| August | |

| Wed Aug 15 22:37:13 2012 Eurozone |

|

| Fri Aug 3 12:06:39 2012 John Keegan |

|

| 2011 | |

| July | |

| Thu Jul 28 23:52:07 2011 The Big Default |

|

| >> Older entries >> | |

| >> links >> | |

| Wed Aug 15 22:37:13 2012 Eurozone How long will the Euro last? |

|

| There has been a litany of bad news lately for the Eurozone.

For one thing, most Eurozone countries have had a crappy Q2, with many countries (particularly the most vulnerable such as Spain and Portugal) seeing a contraction. In general, people fear that a second recession may be about to hit the Eurozone. Greece is sputtering along. It barely avoided bankruptcy in its latest bond (treasury bill) sale, but also saw a contraction of over 6% in the second quarter. However, it is failing to keep up with fiscal reform promises it made in March, and is now asking for a two-year extension to meet bailout terms. What are the odds the Eurozone will survive? Personally, I think several countries (Greece and Portugal) are likely to leave on their own accord, and other countries (Spain) may be kicked out. The core of the Eurozone (countries using the Euro as currency) may remain--Germany, France, and others--but several countries will and should leave. Greece and Portugal have historically spent far more than they earned ( Portugal's record and Greece's record), and have usually devalued their currencies as an effective extra tax to catch up. Now that they are tied to the Euro, this extra taxation source has dried up, and their deficit spending can't be financed. In fact, instead of the ability to devalue their currency to raise money, Greece and Portugal are being hit with austerity measures instead. In a recession, this just makes the problem worse. Portugal is very upset about this, and rightly so. What do Greece and Portugal gain by staying in the Eurozone for the next 5-10 years? Nothing. In fact, staying in the Eurozone will probably push them into years of economic stagnation. I think Greece and Portugal are foolish to stick with the Euro! I'm sure many of them will come to the same conclusion. Over time, I don't see the Euro surviving, for exactly this reason: countries have historically used devaluation as a way to catch up with overspending. Being in the Eurozone denies countries this capability, and they have grown used to it. There is one way the Eurozone could survive: centralize taxation and spending. That is, countries in the Eurozone could not set their own budgets, but would instead send taxes in to a central agency, which would distribute the funds as well. Personally, I don't see that happening, since no country will give up both their tax receipts and their budget discretion. And so, over time, countries will drop out as they feel the need to devalue currencies. I'll give the Euro 10 more years as an independent currency! Comments |

Related: economics > geopolitics < predictions Unrelated: books energy environment lists mathematics science |

| Fri Aug 3 12:06:39 2012 John Keegan One of my favorite authors. |

|

| John Keegan died yesterday (2 August). He was one of my favorite authors, and probably

my favorite author of military history.

I first read John Keegan's classic The Face of Battle, which many consider his best work. Later, I read A History of Warfare, which is as far as I know the only modern-day response to Clauswitz's classic On War. Clauswitz wrote his book after the Napoleanic wars, and it wasn't until Keegan that the famous dictum "War is the extension of diplomacy by other means" was challenged. Keegan's perspective was that war and warfare is more cultural than political. I won't try to explain it here (read Keegan!) but I found his overall take very persuasive. I've read several other Keegan books, such as The Second World War and The Mask of Command. Personally, my favorite of his books was The First World War, which I've heard described as the best single-volume on The First World War there is. Certainly it is the top selling Keegan book on Amazon.com. One of my prize possessions is a signed hardcover version. I'm sorry to hear that Keegan has passed away, but I think that he has already influenced multiple generations of historians and soldiers, and will influence generations more. Comments |

Related: books > geopolitics < Unrelated: economics energy environment lists mathematics predictions science |

| Thu Jul 28 23:52:07 2011 The Big Default Can we please not do this again? |

|

| I enjoyed speculating over the financial problems of Portugal (

Bankrupt Portugal), Greece (

Greece's Surrender), and others (

Sovereign Bankruptcies), probably out of a spate of

schadenfreude.

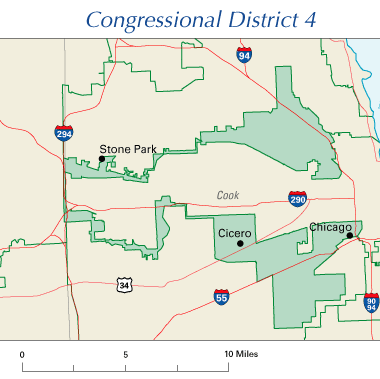

However, now it's our turn. Barring a miracle, on August 2nd the United States will default on its debts for the first time in history. Most of the rest of the world thinks we are complete morons (see stories from London, China and Singapore). Reading the international news is pretty sobering: many countries are quite worried, because a default will have a dramatic impact on them, due to exchanges rates and the (lack of) credit a default would cause. Will we default? I didn't think so a week ago, but now I'm not so sure. The Democrats and Republicans were unable to even talk, and now even the Republicans can't agree among themselves. What should you do?The US default will likely cause markets to take a big hit, and your retirement fund (if invested in stocks or bonds) will likewise drop. How can you avoid that? Actually, I have no idea. I think Gold is overpriced, so I wouldn't go near that. The imminent US default means that normally safe US Treasuries are likely to plummet, so I wouldn't buy them. Cash may be a reasonable option, but exchange rates will go against the dollar, and the government will almost certainly have to use inflation as a way to fight federal debt, which erodes the value of cash over time. I did move a bunch of my savings out of markets and into cash positions, but I don't know if that will help. There are a bunch of kinds of defaults: orderly, strategic, and even strategic sovereign defaults. Those are defaults made by rational people or countries after having evaluated several possible options and picked what they believe to be the best course of action. The US Default will be particularly notorious because it will not be strategic or deliberate, but rather due to the inability of Congress to compromise. How can we stop this from happening again?Ideally, the next time the country faces a crisis, our elected representatives will work together instead of retreating to their respective corners. Really, their current behavior is embarrassing and it's shaming to know that we elected them. One of the big problems is gerrymandering. (Actually, this isn't my idea--I read it recently but now I don't remember the source). Don't get me wrong: we're in this mess because we as a country we have been unable to control spending for the past 30 years. Check out the Wikipedia page on the US Debt to see graphically how every administration since and including Reagan has screwed things up (one exception: Clinton). However we got here, I'd expect Congress to realize the magnitude and seriousness of the problem, and act in the common good of the entire country. Instead, the opposite has happened. The Congress we elected appears to be unable to do anything. And I think gerrymandering is a large reason why. The idea is that because of gerrymandering, we are electing people that aren't actually representative of any real city or area. Instead, our representatives are elected from artificially-constructed regions that encourage extremists of either side, rather than force candidates to try to accommodate the broad views of real communities. How can we stop gerrymandering?I don't recommend changing the voting system, or any of the other more radical solutions. Instead, just require that districts not look weird, like the one above. Interestingly, a bunch of people have looked at how to stop gerrymandering, mostly by looking at more neutral ways to define congressional districts. See examples like this, this, and this. It's clear that a lot of people have gotten annoyed with the effects of gerrymandering and have good ideas to fix them. Check out those sites--it is amazing how bad today's Congressional districts are, and how many better solutions are out there! Comments |

Related: > geopolitics < economics Unrelated: books energy environment lists mathematics predictions science |

| Links: |  |

Blog Directory | Blog Blog | Technorati Profile | Strange Attractor |