| < | Wavepacket Blog |

> |

| << Newer entries << | |

| 2012 | |

| August | |

| Fri Aug 3 12:06:39 2012 John Keegan |

|

| 2011 | |

| October | |

| Mon Oct 10 23:19:52 2011 Occupy Wall Street |

|

| July | |

| Thu Jul 28 23:52:07 2011 The Big Default |

|

| >> Older entries >> | |

| >> links >> | |

| Fri Aug 3 12:06:39 2012 John Keegan One of my favorite authors. |

|||||||

| John Keegan died yesterday (2 August). He was one of my favorite authors, and probably

my favorite author of military history.

I first read John Keegan's classic The Face of Battle, which many consider his best work. Later, I read A History of Warfare, which is as far as I know the only modern-day response to Clauswitz's classic On War. Clauswitz wrote his book after the Napoleanic wars, and it wasn't until Keegan that the famous dictum "War is the extension of diplomacy by other means" was challenged. Keegan's perspective was that war and warfare is more cultural than political. I won't try to explain it here (read Keegan!) but I found his overall take very persuasive. I've read several other Keegan books, such as The Second World War and The Mask of Command. Personally, my favorite of his books was The First World War, which I've heard described as the best single-volume on The First World War there is. Certainly it is the top selling Keegan book on Amazon.com. One of my prize possessions is a signed hardcover version. I'm sorry to hear that Keegan has passed away, but I think that he has already influenced multiple generations of historians and soldiers, and will influence generations more. Comments |

Related: books geopolitics Unrelated: economics energy environment lists mathematics predictions science |

||||||

| Mon Oct 10 23:19:52 2011 Occupy Wall Street Marching to close the barn door after the horse has spent the money? |

|||||||

| The

Occupy Wall Street movement continues to grow, with protests in

Chicago and other cities, although there is

a lot of uncertainty over what its goals or

causes are. Some of the better coverage has been from the

foreign press, who are also trying to make sense of it.

It's definitely a legitimate movement, though, since Ben and Jerry's have supported it. In general, people seem to be angry about the depth of the recession, and angry that Wall Street and the rich seem to be doing well, even while others are having problems finding jobs. The bailout of the banking sector was also a theme. I agree with that! Way back in 2008 I argued that we should not bail out Wall Street ( Just say No), and in fact I wrote an open letter about it to all of my congressional representatives ( Open Letter). What I said at the time:

Instead, I argued for two measures Congress should take instead:

The Occupy Wall Street movement needs causes--I'd recommend those! And maybe a third--don't allow collateralized debt obligations for federally-backed mortgages. Wall Street has taken their $700B bailout (actually, it's taken two of them), so that money is gone. But we can reduce the risk of this happening again by stopping banks from taking leveraged risks with Federally-guaranteed deposits. And we need to get our deficit under control so that the government can spend out of recessions, rather than being stuck with near-bankruptcy. I wish the Occupy Wall Street protesters had woken up in 2008 instead of 2011! But I guess in 2008 people weren't thinking much about a real recession. And I don't have much hope for the movement. I list three concrete proposals here (banking reform, ending CDOs, controlling the deficit) but none of these are on the radar for the protesters. I understand their anger but I haven't seen any practical ideas come out. But I definitely agree with the protesters that the bailouts were bad for many reasons. My final plea to my congressional representatives in 2008:

Comments |

Related: economics Unrelated: books energy environment geopolitics lists mathematics predictions science |

||||||

| Thu Jul 28 23:52:07 2011 The Big Default Can we please not do this again? |

|||||||

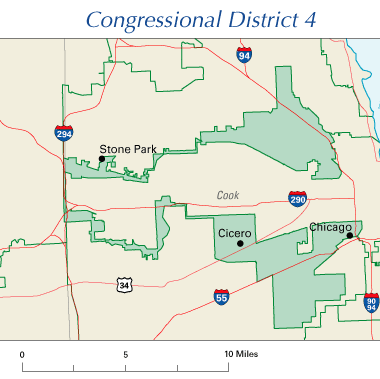

| I enjoyed speculating over the financial problems of Portugal (

Bankrupt Portugal), Greece (

Greece's Surrender), and others (

Sovereign Bankruptcies), probably out of a spate of

schadenfreude.

However, now it's our turn. Barring a miracle, on August 2nd the United States will default on its debts for the first time in history. Most of the rest of the world thinks we are complete morons (see stories from London, China and Singapore). Reading the international news is pretty sobering: many countries are quite worried, because a default will have a dramatic impact on them, due to exchanges rates and the (lack of) credit a default would cause. Will we default? I didn't think so a week ago, but now I'm not so sure. The Democrats and Republicans were unable to even talk, and now even the Republicans can't agree among themselves. What should you do?The US default will likely cause markets to take a big hit, and your retirement fund (if invested in stocks or bonds) will likewise drop. How can you avoid that? Actually, I have no idea. I think Gold is overpriced, so I wouldn't go near that. The imminent US default means that normally safe US Treasuries are likely to plummet, so I wouldn't buy them. Cash may be a reasonable option, but exchange rates will go against the dollar, and the government will almost certainly have to use inflation as a way to fight federal debt, which erodes the value of cash over time. I did move a bunch of my savings out of markets and into cash positions, but I don't know if that will help. There are a bunch of kinds of defaults: orderly, strategic, and even strategic sovereign defaults. Those are defaults made by rational people or countries after having evaluated several possible options and picked what they believe to be the best course of action. The US Default will be particularly notorious because it will not be strategic or deliberate, but rather due to the inability of Congress to compromise. How can we stop this from happening again?Ideally, the next time the country faces a crisis, our elected representatives will work together instead of retreating to their respective corners. Really, their current behavior is embarrassing and it's shaming to know that we elected them. One of the big problems is gerrymandering. (Actually, this isn't my idea--I read it recently but now I don't remember the source). Don't get me wrong: we're in this mess because we as a country we have been unable to control spending for the past 30 years. Check out the Wikipedia page on the US Debt to see graphically how every administration since and including Reagan has screwed things up (one exception: Clinton). However we got here, I'd expect Congress to realize the magnitude and seriousness of the problem, and act in the common good of the entire country. Instead, the opposite has happened. The Congress we elected appears to be unable to do anything. And I think gerrymandering is a large reason why. The idea is that because of gerrymandering, we are electing people that aren't actually representative of any real city or area. Instead, our representatives are elected from artificially-constructed regions that encourage extremists of either side, rather than force candidates to try to accommodate the broad views of real communities. How can we stop gerrymandering?I don't recommend changing the voting system, or any of the other more radical solutions. Instead, just require that districts not look weird, like the one above. Interestingly, a bunch of people have looked at how to stop gerrymandering, mostly by looking at more neutral ways to define congressional districts. See examples like this, this, and this. It's clear that a lot of people have gotten annoyed with the effects of gerrymandering and have good ideas to fix them. Check out those sites--it is amazing how bad today's Congressional districts are, and how many better solutions are out there! Comments |

Related: geopolitics economics Unrelated: books energy environment lists mathematics predictions science |

||||||

| Links: |  |

Blog Directory | Blog Blog | Technorati Profile | Strange Attractor |