| < | Wavepacket Blog only displaying 'economics' posts |

> |

| << Newer entries << | |

| 2011 | |

| July | |

| Thu Jul 28 23:52:07 2011 The Big Default |

|

| March | |

| Thu Mar 24 22:46:19 2011 Bankrupt Portugal |

|

| February | |

| Thu Feb 10 16:39:00 2011 Peak Oil Revisited |

|

| >> Older entries >> | |

| >> links >> | |

| Thu Jul 28 23:52:07 2011 The Big Default Can we please not do this again? |

|

| I enjoyed speculating over the financial problems of Portugal (

Bankrupt Portugal), Greece (

Greece's Surrender), and others (

Sovereign Bankruptcies), probably out of a spate of

schadenfreude.

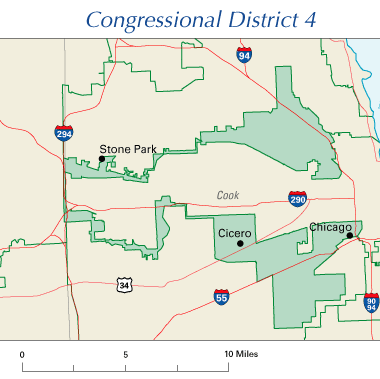

However, now it's our turn. Barring a miracle, on August 2nd the United States will default on its debts for the first time in history. Most of the rest of the world thinks we are complete morons (see stories from London, China and Singapore). Reading the international news is pretty sobering: many countries are quite worried, because a default will have a dramatic impact on them, due to exchanges rates and the (lack of) credit a default would cause. Will we default? I didn't think so a week ago, but now I'm not so sure. The Democrats and Republicans were unable to even talk, and now even the Republicans can't agree among themselves. What should you do?The US default will likely cause markets to take a big hit, and your retirement fund (if invested in stocks or bonds) will likewise drop. How can you avoid that? Actually, I have no idea. I think Gold is overpriced, so I wouldn't go near that. The imminent US default means that normally safe US Treasuries are likely to plummet, so I wouldn't buy them. Cash may be a reasonable option, but exchange rates will go against the dollar, and the government will almost certainly have to use inflation as a way to fight federal debt, which erodes the value of cash over time. I did move a bunch of my savings out of markets and into cash positions, but I don't know if that will help. There are a bunch of kinds of defaults: orderly, strategic, and even strategic sovereign defaults. Those are defaults made by rational people or countries after having evaluated several possible options and picked what they believe to be the best course of action. The US Default will be particularly notorious because it will not be strategic or deliberate, but rather due to the inability of Congress to compromise. How can we stop this from happening again?Ideally, the next time the country faces a crisis, our elected representatives will work together instead of retreating to their respective corners. Really, their current behavior is embarrassing and it's shaming to know that we elected them. One of the big problems is gerrymandering. (Actually, this isn't my idea--I read it recently but now I don't remember the source). Don't get me wrong: we're in this mess because we as a country we have been unable to control spending for the past 30 years. Check out the Wikipedia page on the US Debt to see graphically how every administration since and including Reagan has screwed things up (one exception: Clinton). However we got here, I'd expect Congress to realize the magnitude and seriousness of the problem, and act in the common good of the entire country. Instead, the opposite has happened. The Congress we elected appears to be unable to do anything. And I think gerrymandering is a large reason why. The idea is that because of gerrymandering, we are electing people that aren't actually representative of any real city or area. Instead, our representatives are elected from artificially-constructed regions that encourage extremists of either side, rather than force candidates to try to accommodate the broad views of real communities. How can we stop gerrymandering?I don't recommend changing the voting system, or any of the other more radical solutions. Instead, just require that districts not look weird, like the one above. Interestingly, a bunch of people have looked at how to stop gerrymandering, mostly by looking at more neutral ways to define congressional districts. See examples like this, this, and this. It's clear that a lot of people have gotten annoyed with the effects of gerrymandering and have good ideas to fix them. Check out those sites--it is amazing how bad today's Congressional districts are, and how many better solutions are out there! Comments |

Related: geopolitics > economics < Unrelated: books energy environment lists mathematics predictions science |

| Thu Mar 24 22:46:19 2011 Bankrupt Portugal Another EU domino falls? |

|

| With the

tsunami in Japan, and

continued unrest in the Mideast, it was easy to miss today's headlines that

Portugal's prime minister resigned and

the country needed an EU bailout to avoid default.

Furthermore, not only is Portugal very likely to need a bailout, it increased speculation that Spain may be next. Why did Portugal's prime minister resign? Because all the opposition parties and most of Portugal's organized labor opposed his austerity measures to get the budget under control. Rather than accept the required spending cuts and tax raises to fix the country's fiscal problems, there were strong protests to raise government wages instead. Obviously, that would just make the problem worse, however much the wage increases may be desired or even deserved. This followed a familiar pattern:

Now we see the same pattern in Portugal, and I and others believe Spain will be next. I'll make a prediction that Spain will ask for an EU bailout before the end of 2011. One option may be to let Portugal default! Countries have defaulted before ( Sovereign Bankruptcies). Portugal isn't a complete basket case, and defaulting would still put them in a position where they'd have to enact severe austerity measures, but they could rebuild on their own. A default may not be much worse than an EU bailout anyway, and may be healthy to remind investors that giving your money to governments is not a safe bet. This would raise the borrowing costs for all countries, which would also be a good thing. And it would be a strong message to Spain that it needs to get its own house in order, and not also rely on an EU bailout. But I don't think that will happen. Portugal and Spain will ask for, and receive, EU bailouts instead. Before we in the US start pointing fingers, remember that our own budget is pretty hosed as well. In fact, just yesterday it was noted that our federal disability funds are about to run out because they are being abused by many states. And even without people abusing disability benefits, scheduled spending means Medicare and Social Security will start to hit insolvency in 2017. In fact, Medicare is already running a deficit and is burning through the taxes of previous years. And like everyone facing crises in European countries, even though the mathematics make it obvious that we have to reduce Medicare and Social Security spending, many people don't want their benefits to go down. (However, the latest bipartisan efforts to address the problem are a very encouraging step.) The main learnings? First, deficit spending does eventually catch up to you. And second, if a country lets things get out of control, most people won't want to fix it, because it will mean they'll have less money during the austerity period. That means fixes get postponed until they are too late, and the recovery (if it happens) is much more severe. The main thing is to vote for representatives that will get the budget under control. Representatives are terrified of touching Medicare or Social Security because they think we'll vote them out. We have to let our reps know that we'll support responsible budget planning, even if it means reduced benefits, to avoid bankruptcy. Comments |

Related: > economics < geopolitics predictions Unrelated: books energy environment lists mathematics science |

| Thu Feb 10 16:39:00 2011 Peak Oil Revisited Are oil reserves overstated? |

|

| Today I saw another mention of a leaked cable from the

Wikileaks trove. People are apparently publishing new leaked cables all the time as they find

interesting tidbits.

This particular series of leaked cables showed that throughout 2007-2009, US diplomats believed that Saudi Arabia had overstated its crude reserves by up to 40 percent. In particular, a high-ranking executive at Saudi Aramco, the Saudi Arabian national oil company, stated that he believed their reserves were inflated, and he convinced US diplomats and other international energy experts. In general, there have long been suspicions that OPEC countries have inflated their reserves. It has been hard to tell how worried to be: how much of the bump was due to improved measurements or accounting changes, versus more arbitrary changes? The leaked cables are significant because they indicate that even insiders believe the reserves are arbitrary inflated to a large extent. Does this mean we'll suddenly run out of oil? No, there are still around a trillion barrels of proven reserves. But the Saudi/Aramco reserves are most critical because now that Russian production is declining, Saudi Arabia is the only country in the world who is capable of keeping up with the world's growing oil consumption. And the problem with limited reserves isn't that we run out of oil, instead the problem with limited reserves is that the cheap oil runs out quickly, leaving only more expensive oil to be extracted. And so, over time, oil production peaks. The leaked cables indicate that Saudi oil production could peak in the next ten years, which they say is "not good news." Worse, it means global oil production could peak earlier--if it hasn't already. The bottom line? As I've said before ( Peak Oil), expect gas prices to start going up significantly again, and they probably won't come down. Or if they do come down, it will because of further economic recessions, not improved production. So start planning now! Expect gas to hit $5 or even $10 a gallon in the next ten years. If you do a lot of driving, see if you can move nearer to public transit, because you won't want to be driving much. Comments |

Related: > economics < geopolitics environment Unrelated: books energy lists mathematics predictions science |

| Links: |  |

Blog Directory | Blog Blog | Technorati Profile | Strange Attractor |